Eagle Point, Oregon legal cannabis farmer Jim Belushi has a smile on his face as his Ford Explorer roars up Interstate 5 to Portland—his trunk packed full of Belushi’s Farm pre-rolls, vape carts, and flower, such as Chocolate Hashberry and Captain Jack’s Gulzar Afghanica.

When Belushi gets to the store, his fifth annual crop will fetch a uniquely good price, he told Leafly.

“We can’t keep it in the store. We’re running through it,” said the 66-year-old star of “Growing Belushi” on the Discovery Channel. “This year I might break even, which is very exciting.”

A seller’s market for sinsemilla

Boutique-sized, tenacious, lucky, and happy—the former actor is an exemplar of the 2020 seller’s market for outdoor ganja.

America’s 35 million monthly weed lovers should pounce on fairly priced outdoor at dispensaries this fall. Unlike traditional years when a harvest glut drives prices down, prices should stay pretty firm this harvest season.

Record high, COVID-driven demand for pot has slammed into huge headwinds in the supply of weed, buoying prices.

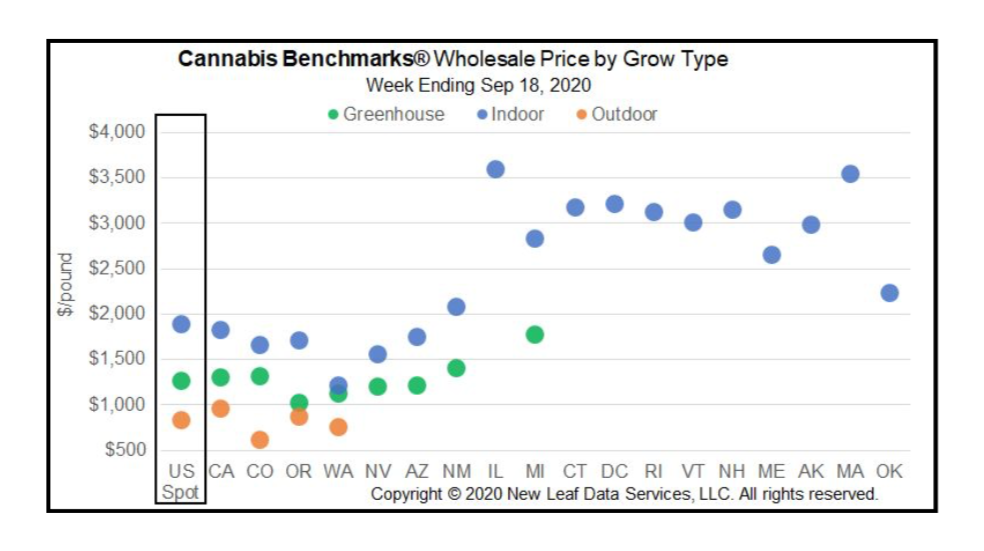

In October, Cannabis Benchmarks’ average wholesale price per pound for the country—their spot index—hit its highest point in three years.

Fires, smoke, government red tape, taxes, and enforcement have suppressed the amount of ganja available.

“You had major fires in every major producing region that runs conventional outdoor,” said industry expert Kevin Jodrey, owner of Wonderland Nursery in Humboldt County, CA.

“All past trends have been thrown out the window at this point,” said Adam Koh, cannabis expert and editorial director at crop data firm, Cannabis Benchmarks in Denver.

Why? Strong demand, throttled supply

This year was supposed to be the year prices continued their decades-long slide. Legalization’s efficiencies reduce prices by up to 90%, researchers at RAND conclude.

Instead, 2020 saw very firm and slightly rising weed prices, thanks to the interaction of natural catastrophe, and manmade policy in 11 legalization states as well as medical marijuana in more than three dozen. Every state tells a slightly different story.

Thirsty smokers in newly legal markets like Illinois and Massachusetts propped up the top of the US price spectrum—$3,600/lb and $3,552/lb, respectively, according to Cannabis Benchmarks.

Meanwhile, outdoor bargain hunters in Colorado and Oregon scooped up the bottom: $1,327/lb and $1,470/lb.

California wholesale pounds for $3,400

Cannabis is a $52 billion US industry and Americans consume 29.9 million pounds of the fast-growing annual each year, according to White House reports.

America’s largest pot producer—California—grows 13.5 million pounds of marijuana, 60% of it outdoors, regulators estimate. Last October, prices dropped 12% at harvest, LeafLink Insights told Leafly in an emailed statement. Not so this year.

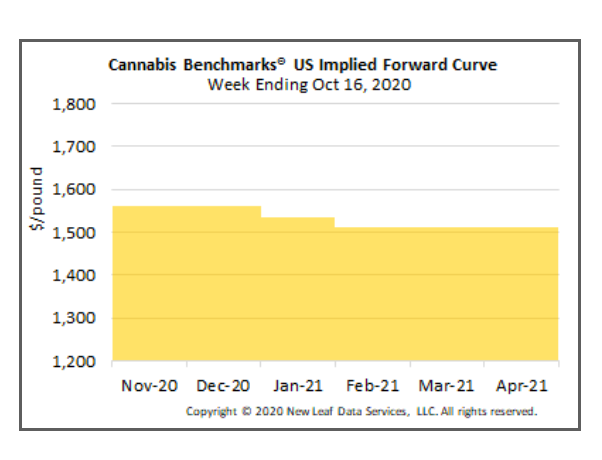

The cost of the average wholesale pound in the US is expected to decline trivially this fall from $1,550 to $1,510—$40 bucks, stated Cannabis Benchmarks.

A wholesale legal pound sold for $3,400 in the California legal market this October.

“A couple of years ago, people thought those days were over,” said Cannabis Benchmarks’ Koh.

“It’s crazy. Everyone’s ecstatic right now because, for a brief moment, there’s money to recapitalize,” said Jodrey.

A new high for demand

Industry analysts concur—2020 saw consumer demand for cannabis “skyrocket,” said Koh.

Colorado has the oldest adult-use market in the world, and it still had its three biggest sales months ever over the summer. July in Colorado was up 36% year over year. Other states reported similarly sizzling business:

- Newborn legalization state Illinois did a record $95.5 million in August sales, surpassing Oregon’s 5-year-old market.

- Mature Oregon was up 30% year over year in August, and prices there have bounced off a 2019 market bottom.

“Cannabis has been doing well,” said Oregon farmer Belushi, who expects to sell all 1,200 pounds he’s growing for 2020.

“And thank God. It means people during this pandemic time—that feeling of loss of control, anxiety, that fear of what’s going to happen next—instead of using liquor, or pills, Xanax, or Ambien, to soothe the screaming inside, they’re choosing cannabis, which I think is great because it’s just such a sweet, gentle, non-violent pathway to healing,” said Belushi.

Stores are a hit

Also driving demand, California added more than 100 new stores and deemed them essential. Clean shops attracted lapsed cannabis users and illicit market shoppers, said Jodrey. “The storefronts are stabilizing. Delivery worked,” he said.

Glass House Group president Graham Farrar said his California stores had “the best months we’ve ever had” this summer. The Santa Barbara-based grower-retailer hired 80 people since the pandemic started.

“Cannabis has this new enthusiasm going for it,” he said.

Supply headwind #1: Fire!

As consumers stocked up on weed, farms raced to keep up.

The US’ supply of cannabis pushed into substantial headwinds this year. Most dramatic among them—historic fires along the West Coast.

In America’s cultivation epicenter—the Emerald Triangle—the skies turned Mars-red and ash rained down on the city of Garberville, CA like the movie Silent Hill, said resident and grower Kevin Jodrey, recalling the August Complex Fire.

The Triangle gets hit every year, but “it was way different this year,” he said. “The amount of impacted cannabis is going to be huge.”